Self-employed person, don't forget to get your insurance!

As a self-employed person, it's up to you to make sure you're properly covered. Let MIA Assurances be your guide!

As a self-employed person, it's up to you to make sure you're properly covered. Let MIA Assurances be your guide!

If you have chosen to work as a self-employed person, you must take out your own health and life insurance policies by yourself. Unlike employees of very small businesses, whose employers are obliged to provide cover, self-employed workers have to do this themselves.

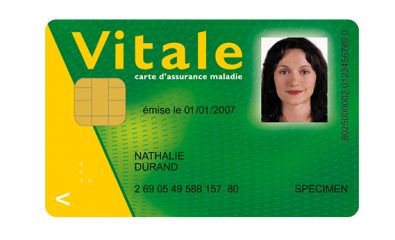

Since the disappearance of the RSI in 2017, self-employed workers have been covered by the general Social Security scheme. As reimbursements from the basic scheme are insufficient, it is important to supplement your reimbursements with a health mutual insurance contract.

There are more and more products on the market for self-employed workers. While it’s not easy to sort through all these offers, we recommend that you begin with:

Find the best self-employed insurance offer

MIA Assurances will take into account your status as a non-salaried worker (Travailleur Non Salarié – TNS) and present you with a policy that falls within the advantageous tax framework of the Madelin Law, allowing you to deduct contributions from your net taxable income. A Madelin policy offers significant financial benefits!

Measure your company’s social climate and the quality of life at work with the Social Barometer

It is crucial to establish a healthy social climate and involve all employees in the…

Sector 2 Practitioners: what does it mean ?

When scheduling an appointment with a doctor, you may wonder about the difference between non-contracted…

Nurturing your employer brand with quality employee benefits

Are you opening your business and discovering the impact of social charges on your profitability?…

What is a state-approved “responsible” supplementary health insurance plan?

When it comes to choosing a company health insurance plan for your employees in France,…